LivePay

An inclusive and free payment solution and e-wallet in Germany

Context

Germany is in love with cash and hate credit card payment. According a study by Germany’s central bank (Bundesbank), Germans pay for nearly 60% of their purchases in cash, lead by an obsession with privacy, mistrust of big-tech and fintech in general. Sweden went nearly cashless (6% of transactions settled with cash) in comparaison. Culturally, cash is seen is a means of self-control, safety and anonymity.

It’s also cheaper for retailers on transactions under 50 euros, as the cost of holding cash is lower than the fees incurred with non-cash payments. But the cost of producing, storing, and transporting bank notes and coins is eventually passed on to consumers, experts say.

The European Central Bank is working on a digital currency, an electronic equivalent to cash issued by the central bank.

Meanwhile, the European Central Bank is working on a digital currency, an electronic equivalent to cash issued by the central bank and available to everyone in the euro area. It would complement banknotes and coins, giving people an additional choice about how to pay. It aims to respect transactions and users’ privacy, to make sure that inflation remains low, stable and predictable, to help people saving and spending and to prevent illegal activities such as money laundering and terrorism financing.

Goals

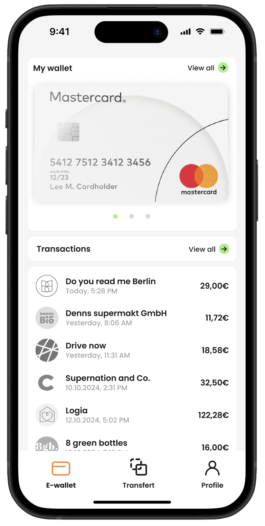

A completely free of charge mobile and desktop payment solution for the users (private person, retailer, shops) to receive and send money including a virtual credit card (e-wallet). The service will prioritize user’s transactions privacy and security (fingerprints, facial recognition, double authentication) + encrypted datas (see European PCI DSS and PSD2 norms).

Role

Ux/Ui designer

Project scale

3 months

Client

Student Project at CareerFoundry

Into user's mind

Let’s try to understand through a survey and some interviews the behaviors of 6 futur potential users in relation to online and cash payments. What are their pros and cons? But also what are their values, practicality and the space they takes in our daily life. Let's organize all the datas with an affinity map.

Competitors

There is no direct competition since this service would be of public interest, free and respectful of users’ privacy. But still, we are a few potentials competitors we spotted:

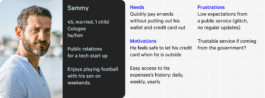

User personas

Why cash is so popular in Germany compared to credit cards? Sarah and Sammy represent a wild sample group of potential future users. They both travel in for work or to visit friends and familly and need to make payments for a service or to friends (peer to peer) in multiple contexts. They are both sensitive to our topic but in different ways. Which is important for us in order to have a wider range of inputs, needs, motivations, frustrations and feedback.

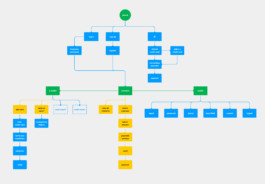

Site map

Let’s visualize the structure and sections of the app and see how the content can be organized. We can then identifies gaps, prioritizes content, and fosters a cohesive design so users navigate the app easily with a clear, logical flow.

Mid-fidelity wireframes

Usability test plan,

affinity map

The goal of the study is to assess the learnability and satisfaction of new users interacting with the app on mobile. We would like to observe and measure if users understand the project, its value, and how to complete basic initial function.

Then, let’s analyse the datas, errors, negative feedbacks and observations, rank the severity of errors (critical, severe, minor) and draw conclusions, to start to think about the possible solutions and next steps to implement improvements.

Design System

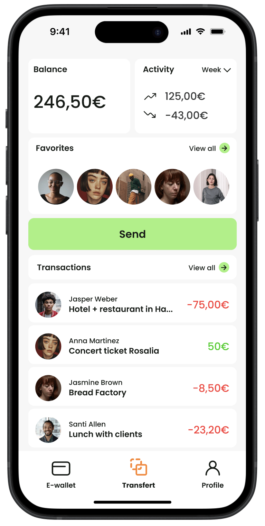

Hi-fidelity prototypes

Use dynamic search to reduce the contact list size and display more contact

The transactions will be free of charge and without commissions for the users (private person, retailer, shops). The service will prioritize security, user privacy Utilizing biometric data such as fingerprints or facial recognition for secure and convenient user authentication during online transactions.

Overall app navigation

The service will prioritize security, user privacy Utilizing biometric data such as fingerprints or facial recognition.

Transfer money to a friend

The transactions will be free of charge and without commissions for the users. The service will prioritize security.